Chargeback handling

Credit cards and debit cards do not offer a guaranteed form of payment for goods or services. Each transaction undertaken is subject to return by a card issuer, even when authorization has been obtained and all standard sales procedures outlined in the Merchant Operating Instructions and Agreement have been followed. The process of returning a transaction unpaid is known as the ‘chargeback’ process. The card schemes define the chargeback process.

Liability for a chargeback must be accepted unless it can be proven that the chargeback is invalid in accordance with card scheme rules, this process is known as a representment or dispute.

The most common reasons for chargebacks include:

- Customer disputes

- Fraud

- Processing errors

A cardholder always has the right to initiate a chargeback (CB): the timeframe in which the cardholder has the opportunity to initiate a chargeback is dependent on the chargeback reason code.

Process flow

As depicted in the below process flow, a chargeback will complete a full circle. It is initiated by the cardholder and/or issuing bank and ultimately, the response provided by you will be presented to the cardholder and/or issuing bank.

It is therefore important to provide the response in the following format:

- English

- Legible

- Professional look and feel

- Structured and organized format

The following information currently only applies to our platform, Ogone platform content is still under construction but will follow shortly.

Reporting

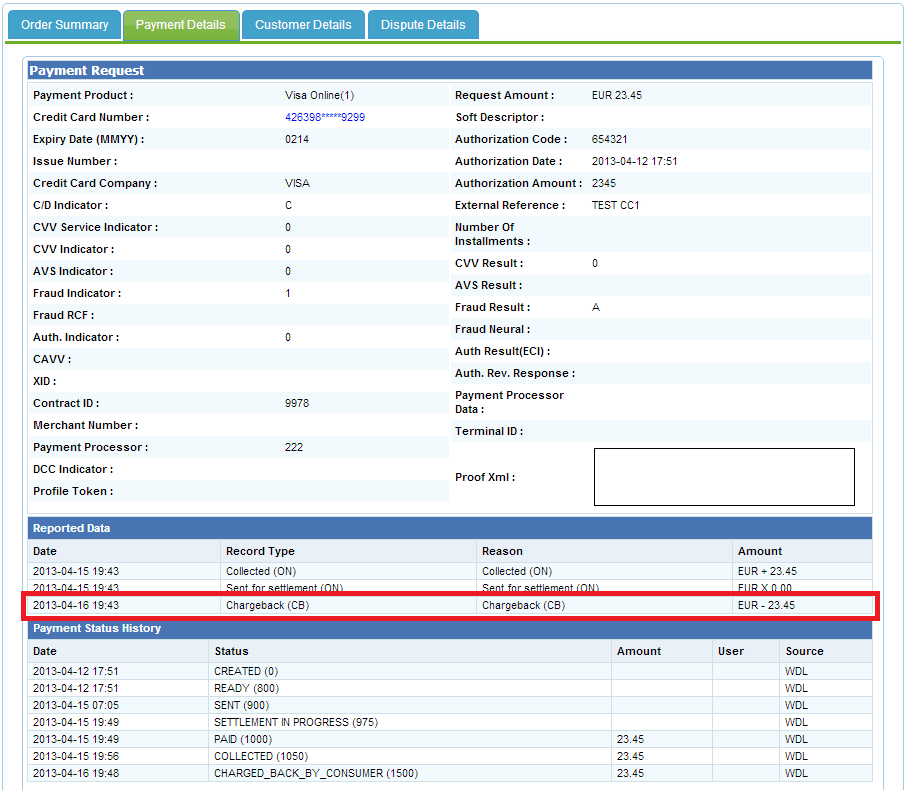

A chargeback is processed by us and will be reported as a chargeback (CB record) in the daily reporting files (WX.file and in the Appendix of the Collection Reports). These reporting files should be well integrated with your own Internal Order System in order to quickly identify the chargeback and take the appropriate action.

Should any problems exist with the integration of the daily reporting files, please contact your dedicated Implementation Manager .

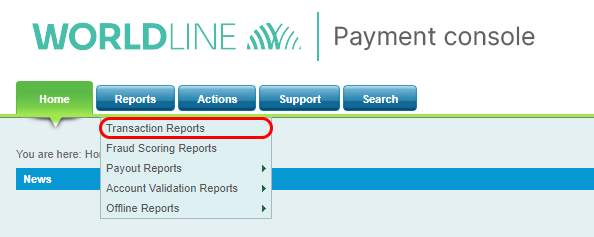

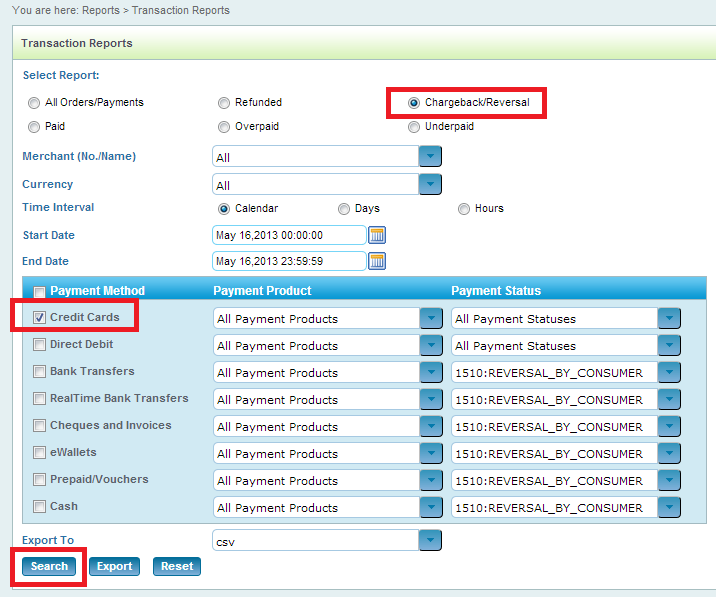

Another method to retrieve chargebacks is by downloading a report in the WebCollect Payment Console. Under Reports/Transaction Reports you will find ‘Chargeback/Reversal’ and from there you can download all the reported chargebacks for a specific time frame.

Once a chargeback has been reported it can be Disputed via the Payment Console.

How to retrieve the chargeback reason code

After a chargeback has been reported, there are two ways in which you can retrieve the chargeback reason code:

- Via the WX file

- Via the Payment Console

The screenshots below will show how to retrieve the chargeback reason from the Payment Console.

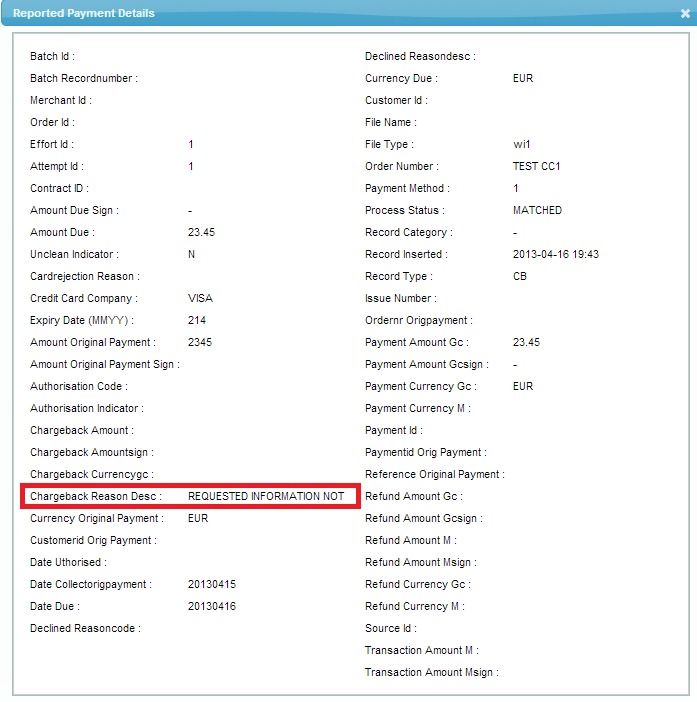

When the chargeback line marked in red is clicked, a new window will pop-up.