Ordering of payment products

What is payment product ordering?

Payment product ordering is a feature that allows you to adjust the order of the payment products you show to your consumers. You can adjust per country which payment products you want to present first to your consumers, allowing you to put the most preferred payment product first based.

How do your consumers see the order of payment products?

It depends on where the payment product selection is shown to your consumers, on how you can easily show your defined order of payment products:

- the payment product selection page of the MyCheckout hosted payment pages of Connect

- your own payment product selection page

The payment product selection page of the MyCheckout hosted payment pages

In case you use the payment product selection page of the MyCheckout hosted payment pages, your consumers will automatically see the order of payment products as defined by you in the configuration center of Connect.

The order of payment products is based upon the country code of the transaction.

Your own payment product selection page

In case you have created your own web page on which consumers can select their favorite payment product, you can use the information we provide to you in the GET paymentProduct(s) call. This API call will provide you the order in which the products ideally are displayed, by giving you a number in the displayOrder property, where "0" is the first product to show, "1" the second etcetera. (the index starts at 0)

How to adjust the order of payment products

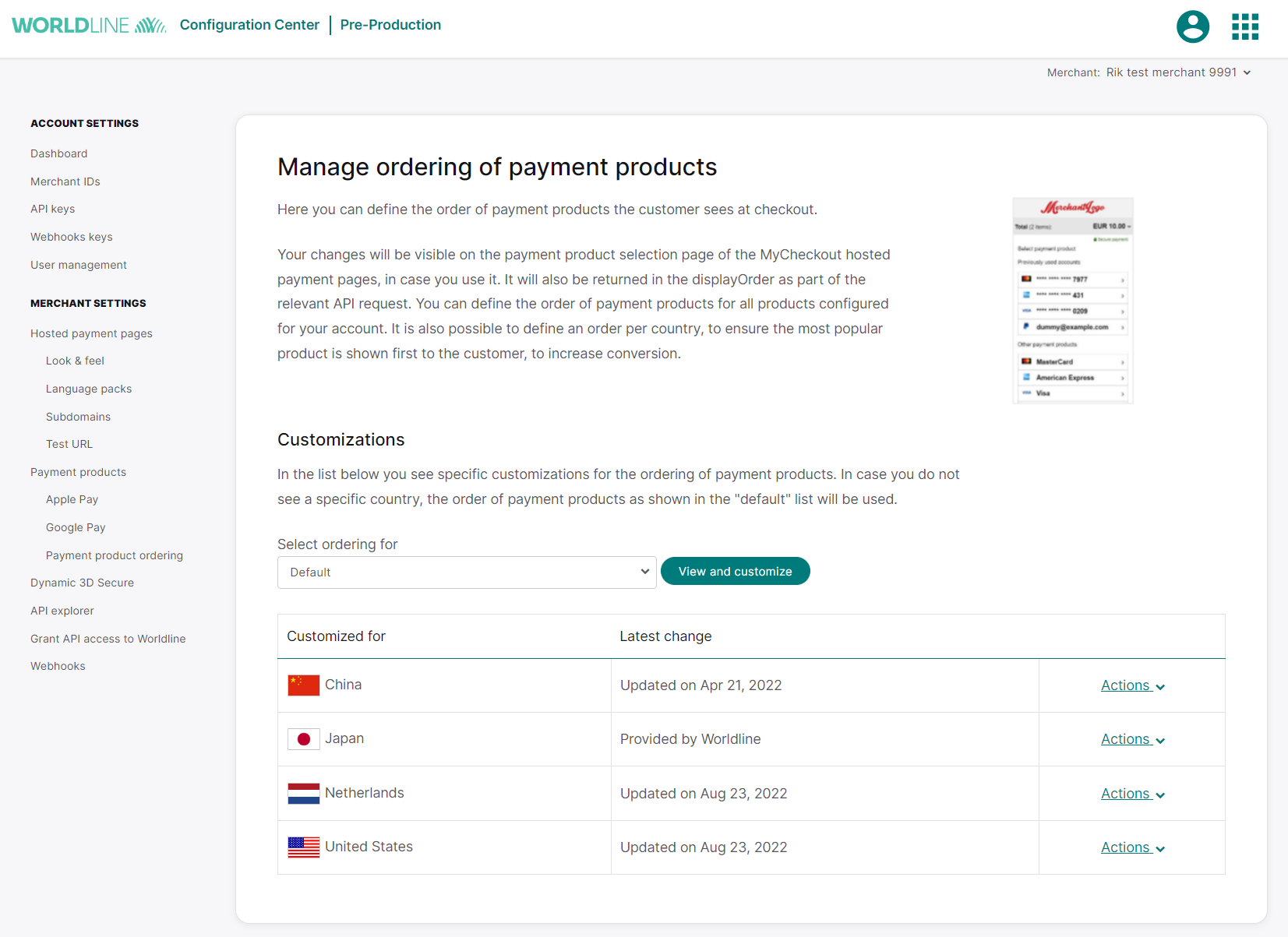

To customize the order of payment products, log in to the configuration center and:

- select the merchant ID at the right top, for which you want to make the customization

- go to "Merchant settings", "Payment products" and select "payment product ordering"

In case you do not see the option to manage the ordering of payment products, please reach out to your contact person at Worldline and ask them to enable the feature for you.

Customizing the order of payment products

To adjust the order of payment products you can choose in the "Select ordering for":

- the country for which you want to adjust the order

- the default option

In the table you see the countries which have an adjusted order of payment products. You can change the order by clicking on the "Actions" button and then on "Edit".

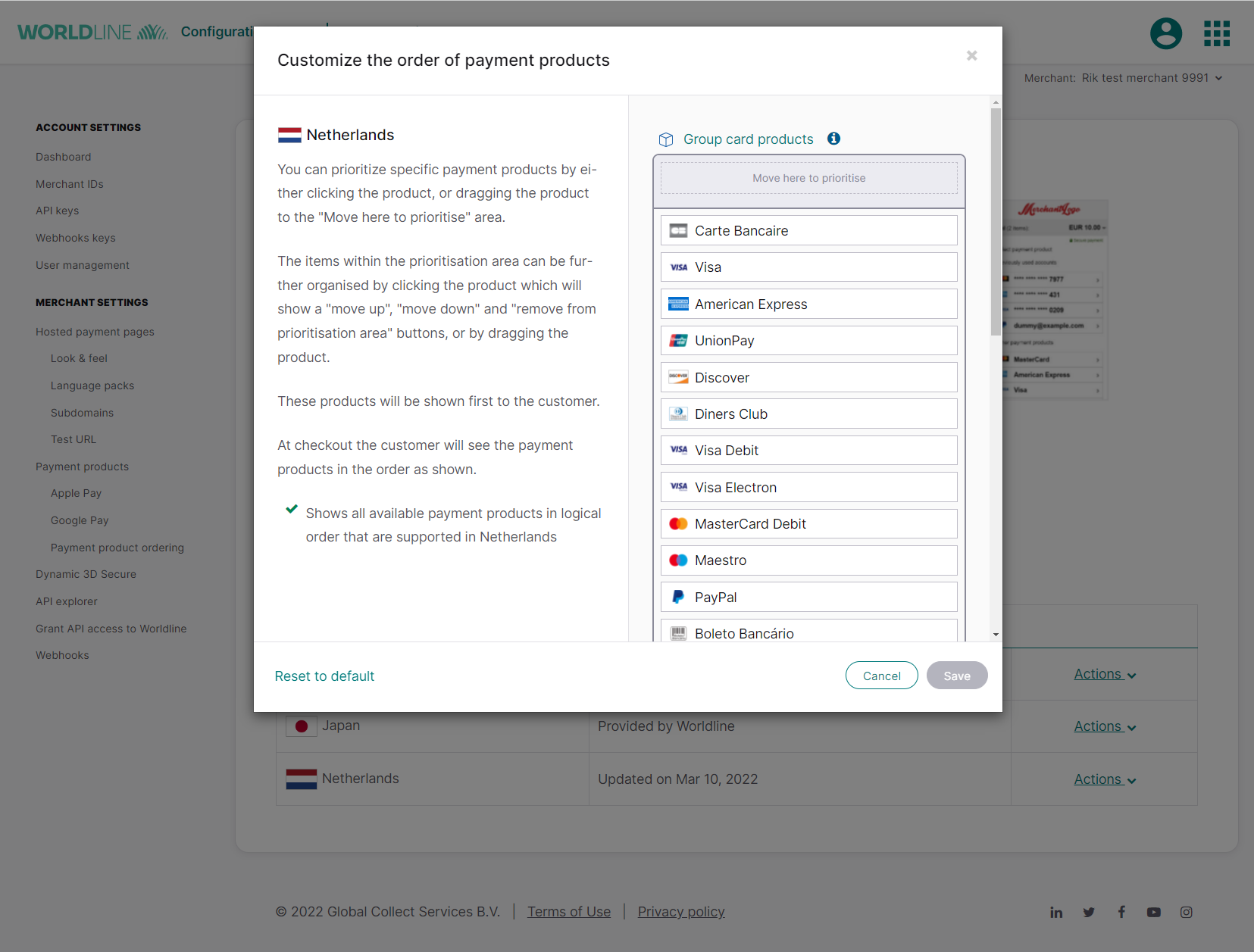

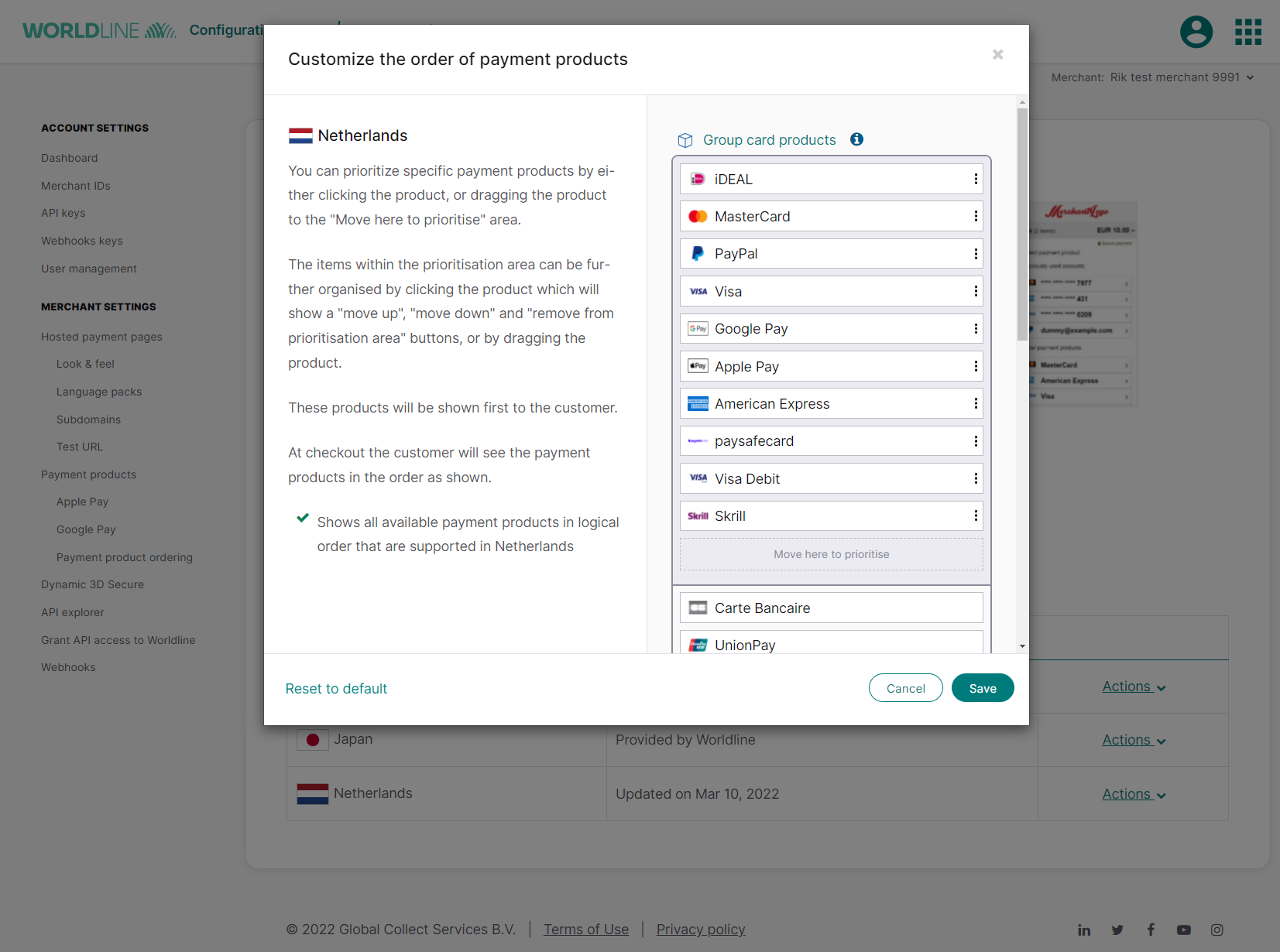

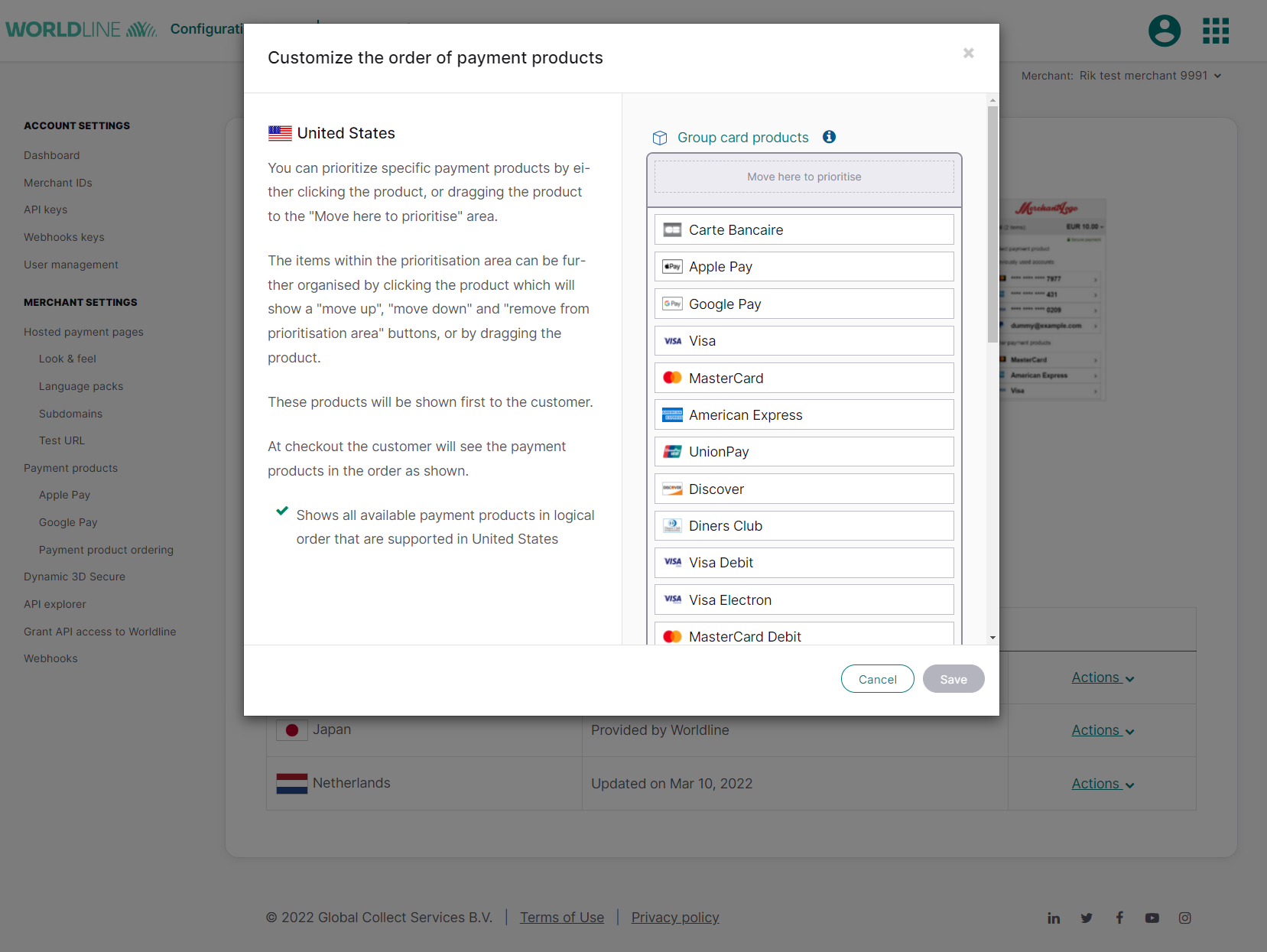

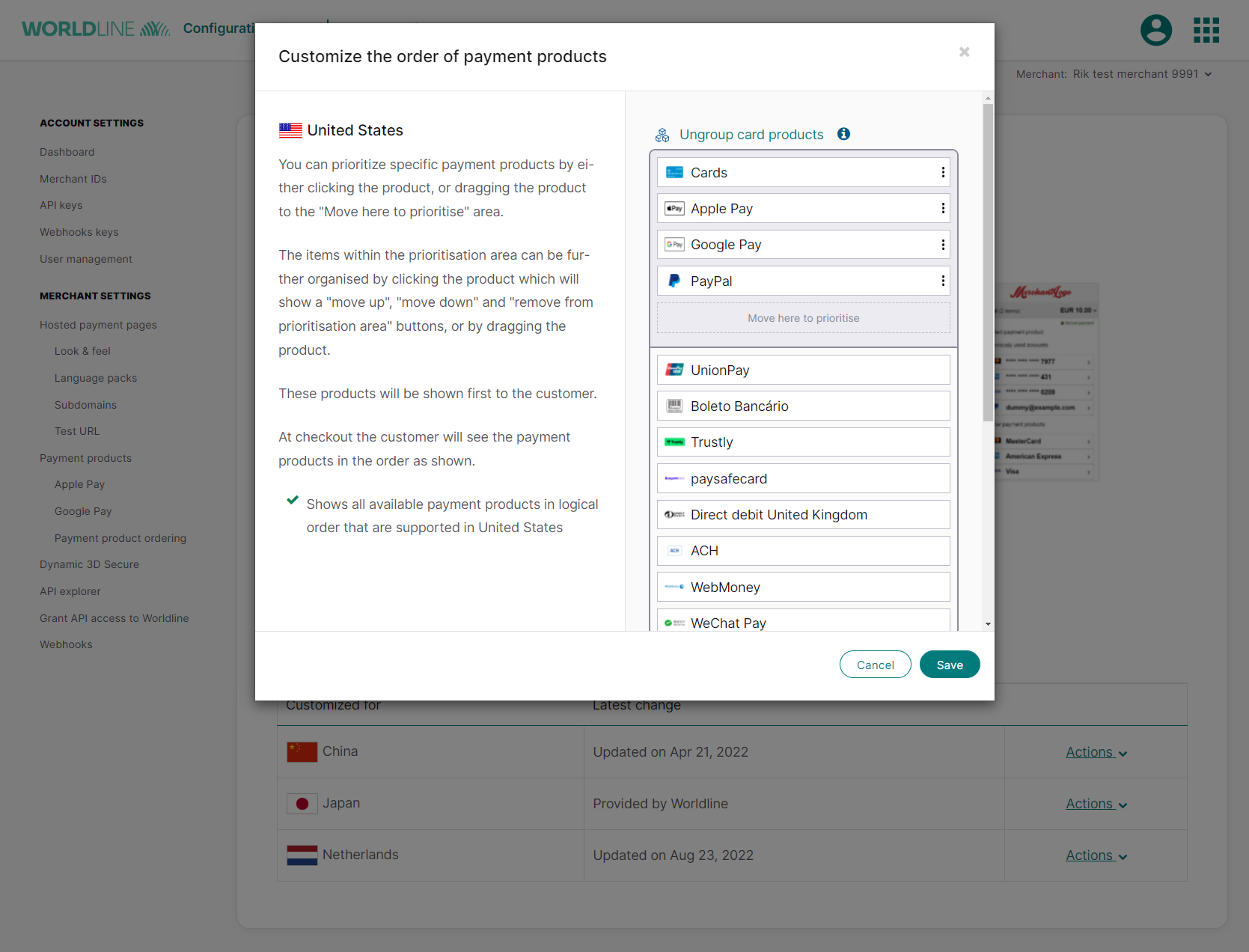

In the pop-up you can adjust the order of payment products:

In the grey customization section, with the text "Move here to prioritise" you can add the payment products you want to be shown first. You can add payment products to this section by clicking on them.

When you have added the products that need to be ordered in the grey customization section, you can further change the ordering by dragging the products higher or lower or by clicking on the 3 dots on the right and selecting the arrow. The arrows can be used to move a product up or down, and the "X" button can be used to move a product back to the default ordering of the payment products. The products which are not dragged to the customization section, will be shown to consumers in the order as you see them in the configuration center, based on the country and currency of the transaction.

The changes you made will go immediately in effect after you saved your changes.

The default order of payment products

The default option contains all available payment products which are configured for your merchant ID and will be used in each country for which no customized order of payment products is available. In case you adjust the order of payment products for the "default" option, it will apply to all countries for which you have not created a specific order of payment products.

Removing your customized order of payment products

You can remove your customized order by scrolling to the country for which you want to remove the customization and clicking on "Actions" and then on "Delete". After you clicked "Delete" the change will go into effect immediately and your consumers will see the default order.

Customization and showing cards as one payment option

If you use our Mycheckout hosted payment pages and show "cards" as one payment method for consumers on the payment product selection page, you can have this same view shown in the customization section as well, by clicking on "Group card products".

Once you have prioritized the cards and then selected the "Group card products" option, it will be shown as one option in the grey customization area.

Please note that showing "cards" as one payment method is a feature you can only enable in the MyCheckout editor. To do so:

- go to "merchant settings" in the configuration center

- select "Look and feel" underneath "Hosted payment pages"

- select the variant for which you want the change to be made

- the MyCheckout editor will open

- go to "variant settings" and select the "Group cards" option

- press save and publish

To receive the order of payment products:

- Send a GET payment product(s) call for the country and currency for which you want to know the order

- Use the displayOrder of the response of this call to put the right order of payment products on your payment product selection page.

Obtaining the order for all payment products

The GET payment products call allows you to retrieve all relevant payment products, based on your configuration and provided filters (like country and currency). Below you see an example of the request for the country United States of America and the currency US Dollar.

GET https://{domainname}/v1/{yourmerchantId}/products?countryCode=US¤cyCode=USD

In the response of this call you will find that for each payment product the property displayHints is returned, which contains a displayOrder. The number in the displayOrder indicates where the payment product should be shown on your payment product selection page, where the lowest number indicates that it should be displayed higher. In below example Visa has displayOrder 0 and will be shown first, followed by Mastercard, American Express, UnionPay, JCB, Discover, Diners Club, Visa Debit and last PayPal.

{

"paymentProducts" : [ {

"deviceFingerprintEnabled" : true,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : true,

"authenticationIndicator" : {

"name" : "AUTHENTICATIONINDICATOR",

"value" : "1"

},

"autoTokenized" : false,

"displayHints" : {

"displayOrder" : 0,

"label" : "Visa",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_1_v2.png"

},

"id" : 1,

"maxAmount" : 10145020000,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "card",

"paymentProductGroup" : "cards",

"usesRedirectionTo3rdParty" : false

}, {

"deviceFingerprintEnabled" : false,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : true,

"authenticationIndicator" : {

"name" : "AUTHENTICATIONINDICATOR",

"value" : "1"

},

"autoTokenized" : false,

"displayHints" : {

"displayOrder" : 1,

"label" : "MasterCard",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_3_v3.png"

},

"id" : 3,

"maxAmount" : 10082050,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "card",

"paymentProductGroup" : "cards",

"usesRedirectionTo3rdParty" : false

}, {

"deviceFingerprintEnabled" : false,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : true,

"authenticationIndicator" : {

"name" : "AUTHENTICATIONINDICATOR",

"value" : "1"

},

"autoTokenized" : false,

"displayHints" : {

"displayOrder" : 2,

"label" : "American Express",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_2_v2.png"

},

"id" : 2,

"maxAmount" : 1014502,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "card",

"paymentProductGroup" : "cards",

"usesRedirectionTo3rdParty" : false

}, {

"deviceFingerprintEnabled" : false,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : true,

"authenticationIndicator" : {

"name" : "AUTHENTICATIONINDICATOR",

"value" : "0"

},

"autoTokenized" : false,

"displayHints" : {

"displayOrder" : 3,

"label" : "UnionPay",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_56_v1.png"

},

"id" : 56,

"maxAmount" : 10145020000,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "card",

"paymentProductGroup" : "cards",

"usesRedirectionTo3rdParty" : false

}, {

"deviceFingerprintEnabled" : false,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : true,

"authenticationIndicator" : {

"name" : "AUTHENTICATIONINDICATOR",

"value" : "1"

},

"autoTokenized" : false,

"displayHints" : {

"displayOrder" : 4,

"label" : "JCB",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_125_v1.png"

},

"id" : 125,

"maxAmount" : 1014502,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "card",

"paymentProductGroup" : "cards",

"usesRedirectionTo3rdParty" : false

}, {

"deviceFingerprintEnabled" : false,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : true,

"authenticationIndicator" : {

"name" : "AUTHENTICATIONINDICATOR",

"value" : "1"

},

"autoTokenized" : false,

"displayHints" : {

"displayOrder" : 5,

"label" : "Discover",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_128_v1.png"

},

"id" : 128,

"maxAmount" : 1014502,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "card",

"paymentProductGroup" : "cards",

"usesRedirectionTo3rdParty" : false

}, {

"deviceFingerprintEnabled" : false,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : true,

"authenticationIndicator" : {

"name" : "AUTHENTICATIONINDICATOR",

"value" : "1"

},

"autoTokenized" : false,

"displayHints" : {

"displayOrder" : 6,

"label" : "Diners Club",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_132_v1.png"

},

"id" : 132,

"maxAmount" : 10145020000,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "card",

"paymentProductGroup" : "cards",

"usesRedirectionTo3rdParty" : false

}, {

"deviceFingerprintEnabled" : true,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : true,

"authenticationIndicator" : {

"name" : "AUTHENTICATIONINDICATOR",

"value" : "1"

},

"autoTokenized" : false,

"displayHints" : {

"displayOrder" : 7,

"label" : "Visa Debit",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_114_v2.png"

},

"id" : 114,

"maxAmount" : 10145020000,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "card",

"paymentProductGroup" : "cards",

"usesRedirectionTo3rdParty" : false

}, {

"deviceFingerprintEnabled" : false,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : false,

"autoTokenized" : false,

"canBeIframed" : false,

"displayHints" : {

"displayOrder" : 8,

"label" : "PayPal",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_840_v1.png"

},

"id" : 840,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "redirect",

"usesRedirectionTo3rdParty" : true

} ]

}

Obtaining the order for one payment product

The GET payment product call is similar to the GET payment products call, but instead of returning information about all payment products configured for the currency and country you send in the request, it will return the information for the payment product for which you requested it. Below you see an example for PayPal.

GET https://{domainname}/v1/{yourmerchantId}/products/840?countryCode=US¤cyCode=USD

In the response you will see the property displayHints, which contains a displayOrder. The lowest number, starting with 0, is the one which should be put highest on the list of payment products you show to your consumers. In this case the displayOrder is 8. To get the full overview of order of products, you will need to perform the GET payment product call for each product separately and in that sense it will be faster to use the GET payment product call

{

"deviceFingerprintEnabled" : false,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : false,

"autoTokenized" : false,

"canBeIframed" : false,

"displayHints" : {

"displayOrder" : 8,

"label" : "PayPal",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_840_v1.png"

},

"id" : 840,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "redirect",

"usesRedirectionTo3rdParty" : true

Regulation in Sweden

In Sweden the Payment Services Act (2010: 751) came into force. It requires that the payment product which is presented first in a situation where a consumer makes a purchase online, is a payment product that does not involve credit.

To adhere to this regulation, the order of payment products your consumer in Sweden will see, is based on the payment products you have configured on your merchantID and will be shown based on below order.

| paymentProductId | Payment product name |

|---|---|

| 806 | Trustly |

| 830 | paysafecard |

| 840 | PayPal |

| 843 | Skrill |

| 11 | Bank transfer |

In case you do not have Trustly configured, we will show paysafecard first to your consumers. In case you have neither of these, we will show PayPal first. If none of these products have been configured for your merchantID, either the default payment product ordering will apply or your customized order for Sweden.

If any of these products are configured for your merchant ID, the one higher up in the list will be shown first to your consumer and can't be changed to another position in the payment product ordering customization. If none of these products have been configured, then the default payment product order will apply or your customized order for Sweden.

For example, if you have PayPal and bank transfer configured on your merchant ID and not the other payment products, the first payment product will always be PayPal. You can prioritize bank transfer in any place you desire, but not above PayPal.

Regulations in Finland

The Finnish Consumer Protection Act (No. 38 of 1978) mandates a specific order for displaying payment products to a consumer during online purchases. Here's how it should be presented:

- Payment products that do not include the possibility of applying for or using credit

- Payment products that may include the possibility of applying for or using credit (e.g., combined cards with both debit and credit features)

- Payment products that involve applying for or using credit

To adhere to this regulation, the order of payment products your consumer in Finland will see is based on the payment products you have configured on your merchant ID and shown based on the below order.

| paymentProductId | Payment product name |

|---|---|

| 806 | Trustly |

| 802 | Nordea Finland |

| 865 | Worldline Accoubt-to-Account Payments |

| 830 | paysafecard |

| 840 | PayPal |

| 861 | Alipay |

| 863 | WeChat Pay |

- If Trustly isn't set up, Nordea Finland will be the first option displayed

- Without Trustly or Nordea Finland, the default is Worldline Account-to-Account Payments

- If none of these are configured, either a default payment order or your custom order for Sweden will be used

When multiple payment products are configured for your merchant ID, they will be shown in the order listed above. This order is fixed and cannot be customized. If none of these products are set up, then either the default order or your custom order for Finland will be used.

For instance, if you have configured PayPal and WeChat Pay for your merchant ID and not the others, PayPal will always appear first. You can place WeChat Pay wherever you prefer in the list, but it cannot be prioritized over PayPal.

Which order will be shown to your consumers?

The order of payment products your consumer sees, depends on whether you have made changes to the order of a specific country or the order of the default list:

- Your customized order of payment products for a specific country will be used

- If you have not made your own customization, the order of payment products for a specific country which is created by Worldline will be used

- If there is no customization for a specific country made by either you or Worldline, your customized default order of payment products will be used

- If there is no customization for a specific country made by either you or Worldline and you have not made changes to the default order of payment products, the default order of payment products created by Worldline will be used.

As explained above, due to the regulations in Sweden and Finland, your consumer will see a non-credit payment product first, irrespective of any customization you made.

The table below explains the priority each order of payment products has over the other, where first priority 1 will be shown and if not applicable, priority 2 etcetera.

| Priority | Which order of payment products | Explanation | Example |

|---|---|---|---|

| 1 | Regulatory requirement | Currently only Sweden requires a non-credit payment product to be shown first | Sweden, Finland |

| 2 | Your customized order for a specific country | Your customization for a specific country will be shown to the consumers of that specific country | Germany, United States |

| 3 | Worldline's order for a specific country | Worldline's order for a specific country The order of payment products as defined by Worldline will be shown | China, Japan |

| 4 | Your customized default order | Your customization of the default order for all countries will be shown to your consumers, based on the country they are in | Default |

| 5 | Worldline's default order | Worldline's default order The default order for all countries will be shown to your consumers, based on the country they are in | Default |