Testing

Positives

Below are the positive test case input definitions with the expected results in the last 4 columns. Positive in this context means that the payments get an authorization. Be aware that the Fraud service can have influence on the final payment status.

| Card number | CVV | Amount | Currency code | Country code | Payment product ID | Auth code | AVS result | CVV result | Payment status ID |

|---|---|---|---|---|---|---|---|---|---|

| 371449635398431 | 123 | 11006 | USD | US | 2 | OK1443 | Y | P | 600 |

| 371449635398431 | 999 | 1100 | USD | US | 2 | OK1456 | Y | P | 600 |

| 371449635398431 | 999 | 11008 | USD | US | 2 | OK2318 | Y | P | 600 |

| 371449635398431 | 123 | 733 | CAD | CA | 2 | OK2424 | Y | M | 600 |

| 371449635398431 | 123 | 1000 | USD | US | 2 | OK1131 | 0 | M | 600 |

Currencies

To be able to test every single currency as listed in the currency table, please use following details.

| Card number | CVV | Amount | Currency code | Country code | Payment product ID | Auth code | AVS result | CVV result |

|---|---|---|---|---|---|---|---|---|

| 371449635398431 | 432 | 1000 | See curr. table | NL | 2 | OK1131 | 0 | M |

Fraud Services

Fraud services are by default enabled. The field CITY is controlling the outcome of the fraud check:

| City | Fraud Result | Payment status |

|---|---|---|

| Amsterdam | A(ccept) | 600/800 |

| Calais | C(hallenged) | 525 |

| Denver | D(eny) | 160 |

For the 525 status a formal decision is required to accept the payment or decline it. The API processchallenged is needed to accept the payment; the status will change to 800. When the payment needs to be declined the CancelPayment will set the status to 99999 (cancelled).

It is also possible to turn off the fraud services per transaction by adding skipFraudService: True to the request. There will be no fraud result in the responses.

3D secure

On payment product id 117 (maestro) 3d secure is enabled as all Maestro transaction are mandated to be processed with 3D secure.

AVS

Address verification is enabled on all cards that support it. Different cases give different AVS result. In case the card type isn’t supporting AVS, the result will always be 0.

Delayed settlement

By default all transaction are set to Delayed settlement, except for the product that don’t support it. In Sale mode, payment will lead to status 800.

In Auth/Capture mode, a payment will lead to status 600, which subsequently requires to do a ApprovePayment to make the status go to 800.

Card verification

Also known as 0$ authorization. This type of transaction is triggered with an amount of 0 and will only return a validated response resulting in a status of 300 and only works on a recurring model.

Refunding

Transactions are not refundable on status Completed with status ID 800, as for that a separate process is scheduled to have the payment end up on a refundable status. Please wait for 1 hour for all your test transactions at status Completed with status ID 800 to be processed like this and set to be ready for refunds.

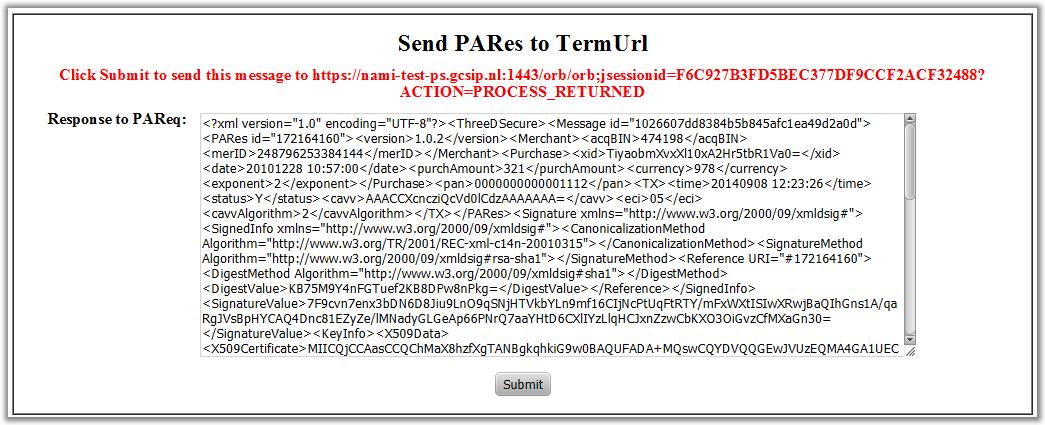

3D secure handling

For the handling of transaction with 3D secure a redirect takes place for the consumer. In the Sandbox it will not show a login screen but a functional HTML form that needs to post the 3D secure validation to the payment platform. Please use that process to simulate the authentication process. The post action triggers the right action to be able to finish the payment.

The redirect behavior back and forward are as it would be in real production systems.

Sample of the form:

Next Additional information