Process flows

Note: In order to integrate RuPay (Credit & Debit), please refer to our API Reference.

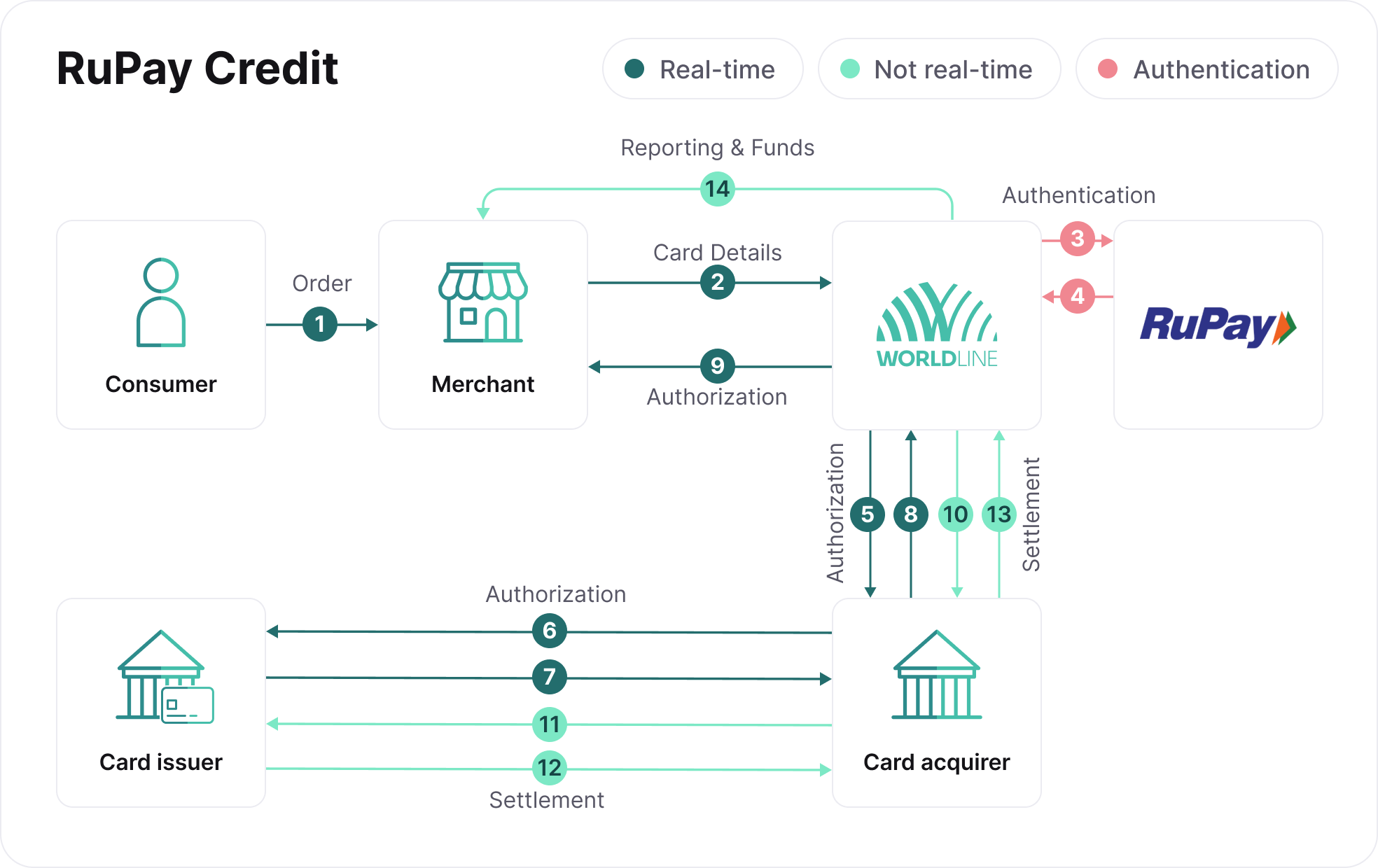

- The consumer selects a card payment product and makes a transaction with you.

- Your server sends the authorization request to us containing the card payment details of the consumer and your reference ID.

- Before authorizing the transaction we first send the transaction for authentication

- If authentication is completed, the transaction continues

- We redirect the authorization request to the relevant acquiring channel.

- The acquirer redirects the authorization request to the card issuing bank.

- The card issuing bank processes the transaction in real-time, returning an authorization or decline response.

- The acquirer sends the authorization result to us.

- We return the request response result to you - If the request is authorized, you can choose to release the product or service to the consumer.

- We will also, automatically or after a request for capture, send the settlement file to the acquirer to facilitate collection of a successfully authorized transaction.

- The acquirer sends the settlement request, via the card scheme, to the card issuing bank and the consumer‘s account will be debited accordingly.

- The card issuing bank transfers, via the card scheme, the funds to the acquirer.

- The acquirer transfers the funds to our bank account where the confirmation of funds is registered.

- You will then receive the funds and a payment report which will include your payment reference – This enables you to update the relevant orders based on the information contained in the report.

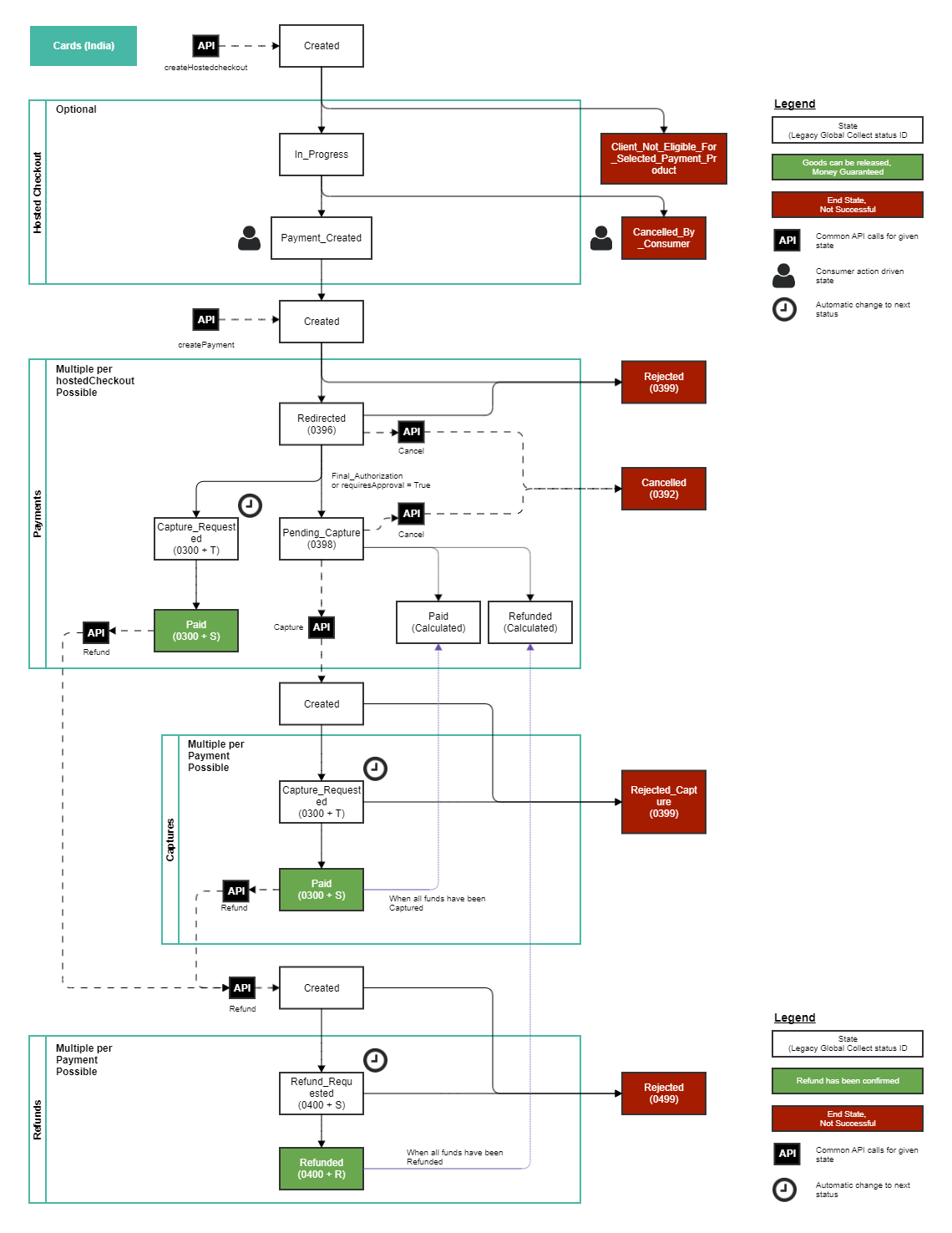

During the transaction process the payment status is updated each time a request or response is received and the changes are reported to your system.