# Trending

Announcing new mobile Flutter SDK for Connect

27 Feb 2024Georgios Hadjigeorgiou, product manager

We're thrilled to announce our brand-new Flutter SDK! This tool is designed specifically for the Flutter framework and written in Dart programming language to interact with our Client API. It's set to revolutionize the seamless integration of in-app payments!

Navigating Mastercard's revised standards for subscription payments

16 Jan 2024Connect team

Mastercard implemented new requirements related to a subscription/recurring billing model, a negative option billing model, or both, as explained in their AN 4934 Revised Standards. The objective behind these changes is to ensure a positive cardholder experience and mitigate negative practices associated with these payment types. What do you need to do to stay compliant?

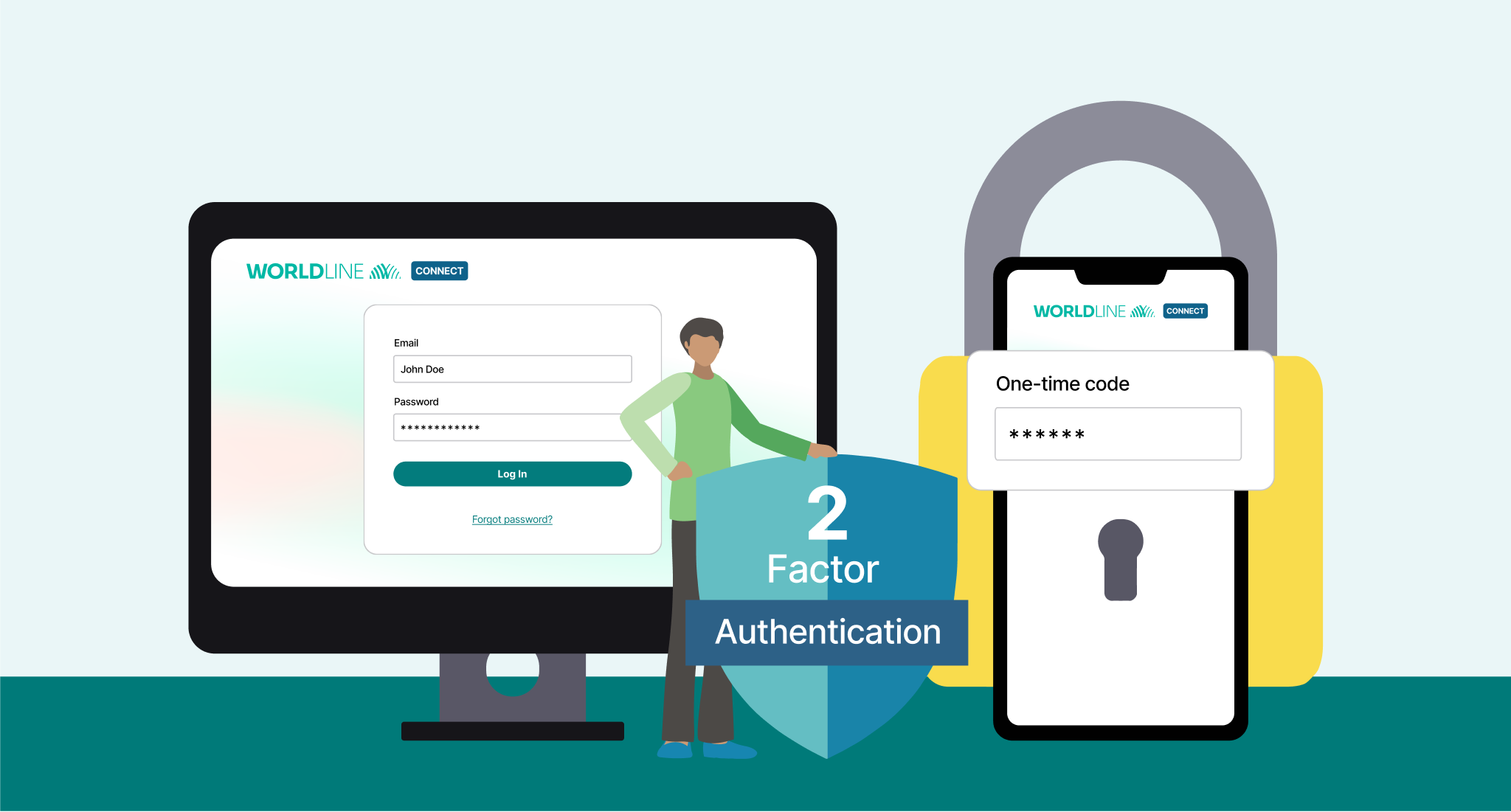

Enabling two-factor authentication in Configuration Center

28 Nov 2023By Milena Anisimova, technical writer

Introduction

Having the security of your data as one of our core priorities, we've enabled two-factor authentication as an extra layer of protection for the Configuration Center, which you use for managing your integration with us on your end. Setting up two-factor authentication is a straightforward process that will reduce the risk of unauthorized access.

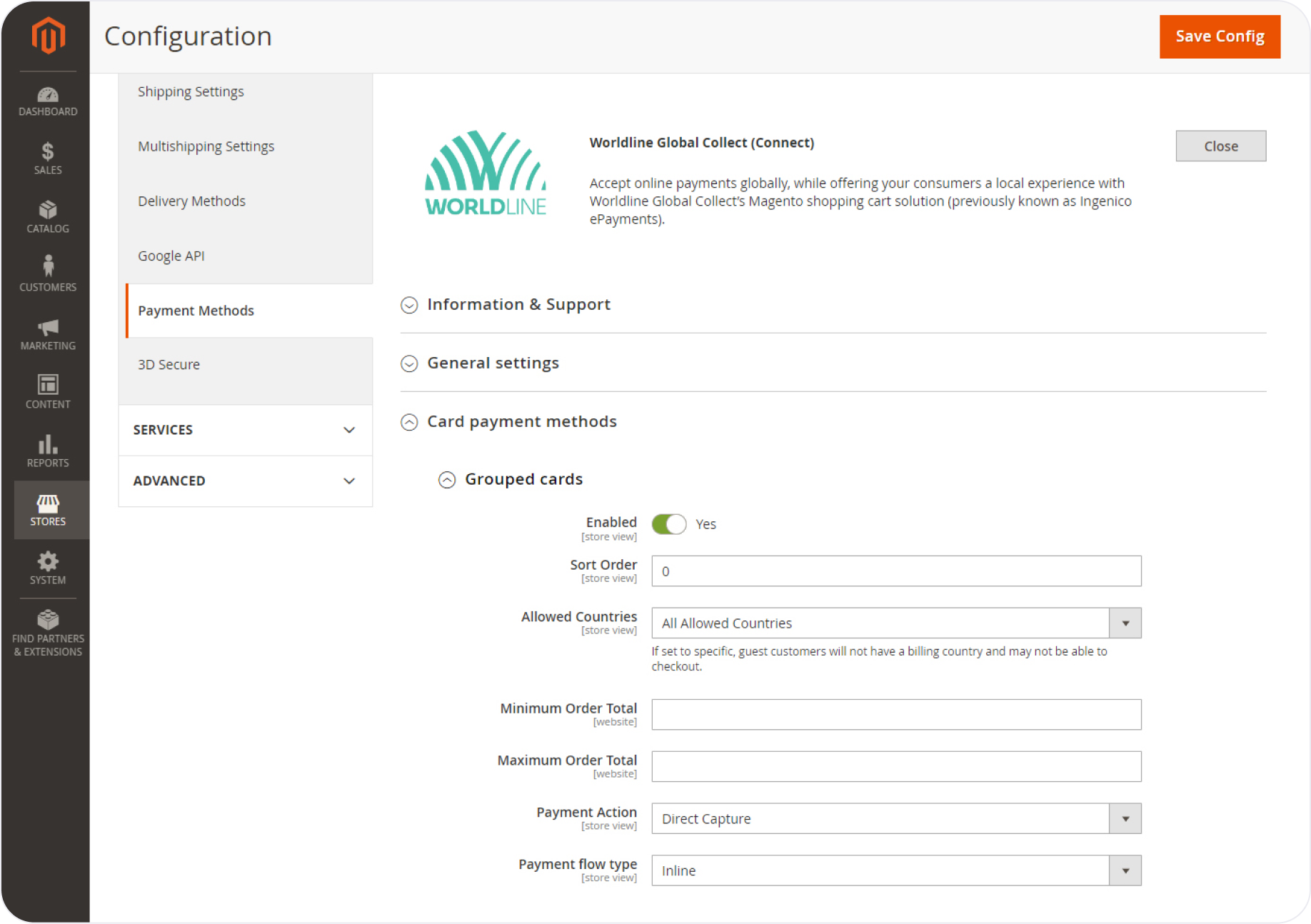

Magento 2 plugin by Connect is live

07 Sep 2023By Erzsebet Kupa, Product manager

Introduction

Expand your business globally and offer a smooth payment experience to your customers with our plugin made for Magento 2. Our user-friendly extension combines the features of the GlobalCollect platform into a seamless integration, ensuring full synchronization with Magento. You can view order summaries and log files in the Magento admin panel, and get the detailed overview of the transactions with just one click using our reporting tools.

Introduction of 8-digit BIN

21 Dec 2021By Marielena Viera, Product manager

Introduction

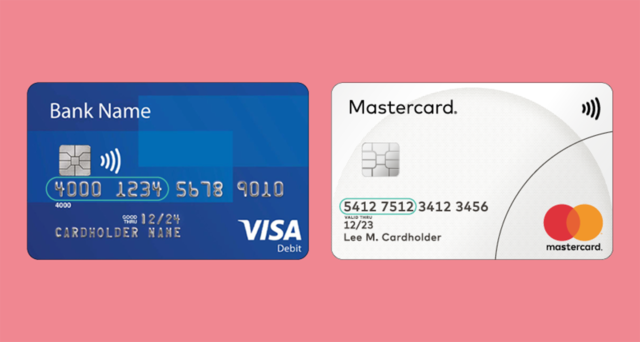

The card organisations Visa and Mastercard will extend the BIN (Bank Identification Number) of their cards from 6 to 8 digits globally on April 1st 2022. Among other things, the BIN is used by merchants and Payment Service Providers (PSPs) for routing transactions for authorisation, fraud prevention, loyalty programs or reportings. The change of the BIN-length is a regulation change. Whether you are in face-to-face business or e-commerce, as a merchant you need to be compliant next year.

The first 6 digits of the Primary Account Number (PAN) of credit, debit and prepaid cards are called Bank Identification Number (BIN), known in our platform as Issuer Identification Number – IIN. This number is generally used to identify the scheme, the issuers and can allow you to retrieve other payment information like the card type or the currency used.

Because of the increasing demand by issuers, the International Organisation for Standardisation (ISO) introduced a new standard. The card organisations Visa and Mastercard will extend the IIN of their cards from 6 to 8 digits globally on April 1st 2022. The general length of the card number (e.g. 16 and 19 digits for Visa and Mastercard in Europe) will not change.

Visa and Mastercard are implementing the new 8-digit standard from April 2022.