Bank account validation

Key for any business is that companies have the correct payment details of their customers. Bank Account Validation ensures that only accurate data is captured to ensure efficient automated payment processes and to prevent data entry errors and rejections in payment processing. Time and costs will be reduced since no payment errors have to be rectified. Your consumer will not experience any inconvenience when processing the payment.

In order to guarantee the best possible data, Worldline works with Experian, one of the market leaders in delivering data and data instruments. This API call validates entered bank details against country-specific rules.

In order to use the Bank Account Validation Services, please refer to our API Reference.

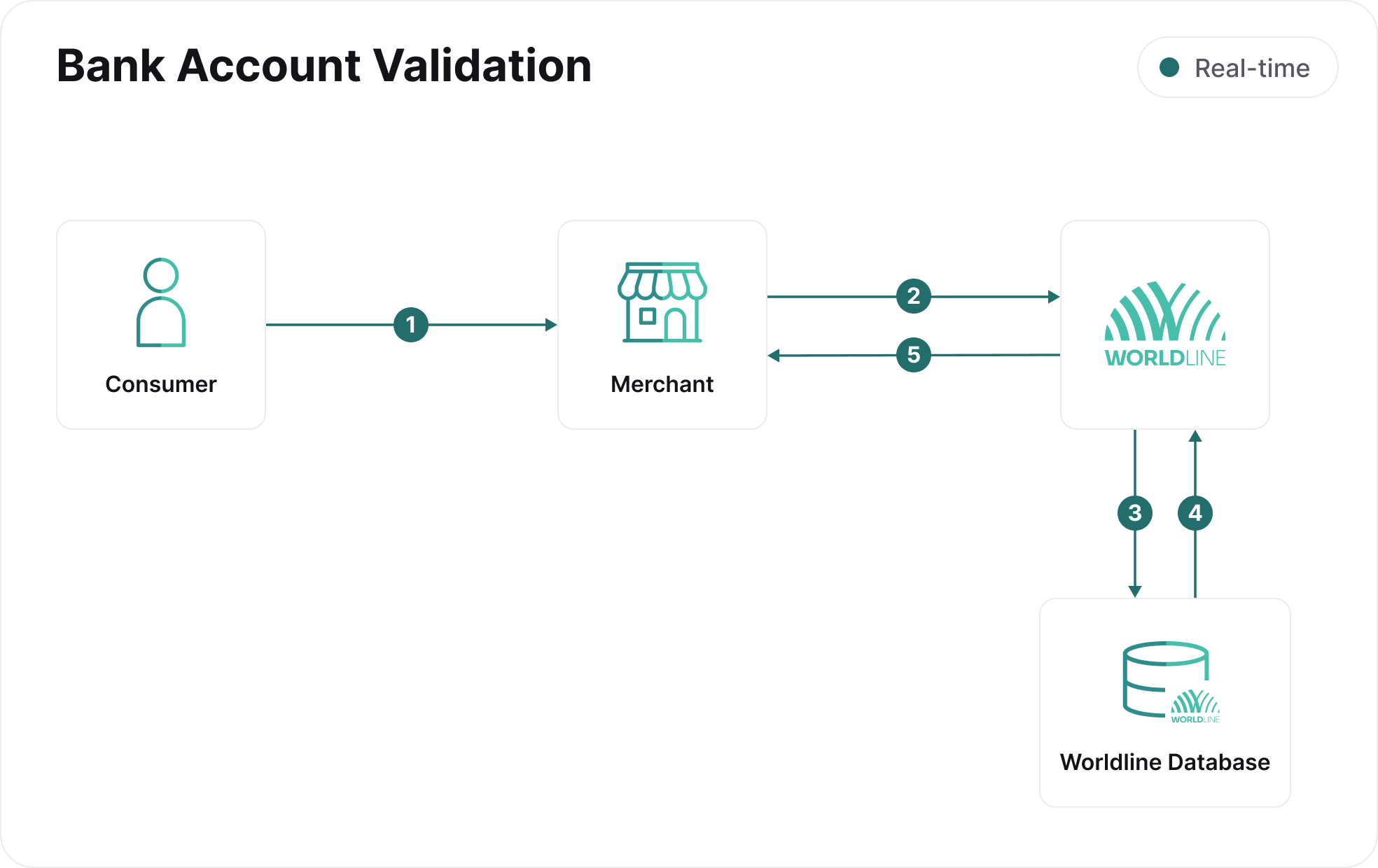

- The consumer provides the bank account details to you.

- You provide the bank account details in the request to us.

- Based on the actions requested in the request, we will check the format of the bank account details, or do a risk assessment on the provided account details.

- The results are returned by the system.

- The results are provided to you.

Two-step bank validation solution

Step 1 - Check your syntax and your system

In the first step, the format of the provided data is validated (Step 1-5 of above flow) and the system will check if the validation can be performed successfully. In this step also the validity of a BIC will be checked (if provided).

The following results are possible:

- OK - The system returns an OK when this step is successful and the validation check can proceed to step 2.

- NOK accompanied by an error code - The system returns a NOK when this step is unsuccessful and the validation check cannot proceed.

Step 2 - Risk Assessment

The validation is performed and the return rows display the results of the different validation checks.

The following results are possible:

- PASSED

- WARNING

- ERROR

- NOTCHECKED - Appears if an earlier check prevents the next check from being performed.